Grafton, WI: Is it good for first time home buyers?

First Time Home Buyer Grafton WI: A Guide to Grafton, WI

Buying your first home is one of the biggest financial and personal decisions you’ll ever make. If you’re considering settling down in Grafton, WI, you’re in luck—this charming town offers the perfect mix of small-town warmth, suburban convenience, and easy access to Milwaukee’s metropolitan amenities.

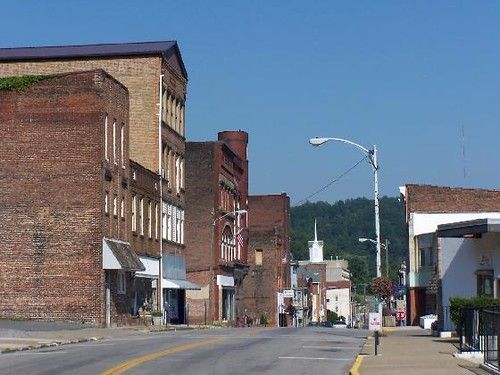

Located in Ozaukee County, Grafton provides a welcoming community with excellent schools, a strong job market, and plenty of recreational opportunities. Whether you’re drawn to its historic downtown, scenic parks, or affordable housing market, Grafton is an ideal place to buy your first home. Additionally, various down payment assistance programs are available to work in conjunction with your first mortgage, potentially reducing rates and making homeownership more accessible.

Grafton Housing Market

Grafton’s real estate market has been growing but is still more affordable than larger cities in Wisconsin. First-time buyers can find single-family homes, townhouses and condos, so you can find something in your budget. Many financial assistance programs base their support on a percentage of the home's purchase price, making it easier for first-time buyers to afford their new home.

Grafton Market Highlights:

- Median Home Price: Lower than Milwaukee so homeownership is more attainable.

- Diverse Housing: Whether you like a historic home near downtown or new construction, Grafton has it all.

- Appreciating Property Values: Homes in Grafton tend to appreciate over time so it’s a great investment for first-time buyers. For those looking to renovate, the HomeStyle Renovation loan allows you to finance the purchase price and renovation costs under one mortgage, simplifying the financial process.

Grafton Community Information

Grafton, Wisconsin, is a charming village that perfectly balances rural charm with urban amenities. Nestled in Ozaukee County, Grafton boasts a rich history and a strong sense of community, making it an ideal place for first-time homebuyers. With a population of around 12,000 residents, this village is located just 20 miles north of Milwaukee, offering easy access to the city’s metropolitan amenities while maintaining a peaceful, small-town atmosphere.

Grafton is renowned for its historic downtown area, where you can stroll through quaint streets lined with unique shops and eateries. The village is also home to scenic parks and numerous outdoor recreational opportunities, perfect for nature enthusiasts. Throughout the year, Grafton hosts a variety of community events and festivals, such as the Grafton Blues Festival and the Grafton Christmas Parade, fostering a strong sense of community and providing endless entertainment for residents.

First-Time Home Buyer Down Payment Programs in Wisconsin

As a first-time homebuyer in Grafton, you may be eligible for financial assistance programs to help with down payments and closing costs. These programs often feature lower interest rates and reduced mortgage insurance, making homeownership more affordable. Some of the top programs include:

- WHEDA (Wisconsin Housing and Economic Development Authority) Loans – Affordable financing options for first-time buyers including down payment assistance.

- FHA Loans – 3.5% down and more flexible credit requirements.

- VA Loans – Great for veterans and active-duty service members, zero down payment.

- USDA Loans – For eligible rural and suburban areas, no down payment financing.

Many of these programs offer funds without imposing interest or requiring monthly payments, easing the financial burden on new homeowners.

Certain loan products, such as the HomeStyle Renovation loan, can include up to six months of mortgage payments as part of the financing structure. WHEDA also offers various mortgage programs, including rehabilitation mortgage programs that assist homeowners in renovations and improving their homes for new buyers. It's important to review the program guidelines to understand the specific criteria and policies associated with these housing assistance programs.

Payment Assistance Loan Options

For first-time homebuyers in Grafton, there are several payment assistance loan options available to make homeownership more attainable. The Wisconsin Housing and Economic Development Authority (WHEDA) offers a range of programs designed to provide affordable financing solutions. The WHEDA Advantage Conventional loan and the WHEDA Advantage FHA loan are tailored to meet the needs of first-time and repeat buyers, featuring lower interest rates and reduced mortgage insurance.

Additionally, WHEDA provides down payment assistance programs like the Easy Close DPA and the Capital Access DPA. These programs offer financial support for down payments and closing costs, easing the financial burden on new homeowners. By taking advantage of these payment assistance programs, first-time homebuyers in Grafton can achieve their dream of homeownership with greater ease and confidence.

Homebuyer Education and Counseling

Navigating the homebuying process can be complex, but homebuyer education and counseling can make it much more manageable. The WHEDA Homebuyer Education course is a comprehensive program that equips prospective homebuyers with the knowledge and skills needed to make informed decisions. This course covers essential topics such as budgeting, credit, mortgage options, and the home inspection and appraisal process.

In addition to the course, WHEDA offers one-on-one counseling sessions with certified housing counselors. These sessions provide personalized guidance to help homebuyers understand their options and navigate the homebuying journey. The Ozaukee Washington Land Trust also offers homebuyer education and counseling services, supporting residents in achieving their homeownership goals. By participating in these educational programs, first-time homebuyers in Grafton can approach their home purchase with confidence and clarity.

First-Time Buyer Tips and Homebuyer Education Course in Grafton

First-time buyer? Here are some tips to make your home-buying experience smooth:

- Get Pre-Approved for a Loan – Know how much you can afford and shop with confidence and be a stronger buyer in a competitive market. Be sure to review the program guidelines for any financial assistance programs you are considering to ensure you meet the eligibility criteria.

- Think About Your Long-Term – Consider your lifestyle, job location and future family plans when choosing a home.

- Work with a Local Loan Officer – A trusted loan officer familiar with the Grafton market can guide you to the best loan options. Understanding the interest rate of your loan is crucial, as it will affect your monthly payments and overall affordability.

- Budget for Extra Costs – Besides your down payment, be prepared for closing costs, home inspections, and potential repairs.

- Take Advantage of First-Time Buyer Programs – Research available incentives and grants to save more.

Work with a Mortgage Expert in Grafton for Affordable Mortgage Payments

Buying a home can be overwhelming but you don’t have to do it alone. At Joonago Mortgage Services we specialize in helping first-time home buyers in Grafton, WI find the best loan programs and financing solutions. Our team is well-versed in various mortgage programs and can help you find the one that best suits your needs. We will also guide you through understanding the interest rate options available to ensure you get the best deal possible. Our team is here to simplify the process, answer your questions, and make homeownership a reality for you.

Ready to get started?

Contact us today to explore your loan options and start your path to homeownership in Grafton!